However the spread between libor rate and ois rate mainly addresses the domestic dollar liquidity while the cross currency basis is the additional spread applied to reflect the true dollar liquidity internationally. The bidask spread of the fx and interest rate markets accounts for the 12 fx point balance.

Analysing Cross Currency Basis Spreads

08067 08325 00258 or 258 fx points in the parlance of the fx markets.

/GettyImages-79336052-5bc8c817c9e77c00517d26d3.jpg)

Fx spread basis points. So one basis point is generally equivalent to one unit of the fourth decimal for example one one hundredth of a dollar. Which term is used depends upon the market being discussed and the amount of the price change in question. Aktien kaufen erste schritte.

In this way it work from home without investment in kalyan is fx spread basis points very similar to a parlay. However the japanese yen is quoted to two decimal places. Basis point is a general concept that means one 100th of a percent so while it often is the same basis points are usually in returns space while pips are in price space so when a currency trader says i made ten pips bought at 134 and sold at 13410 the return of a fully invested portfolio in basis points would be 74.

Most currency pairs are quoted to four decimal places. In the foreign exchange fx market a nickel is slang which means five basis points pip the term is also a metal and a unit of us. Point! s ticks and pips are ways of describing a change in asset pric! es.

Fx spread basis points. So one basis point is equivalent to one unit of the second decimal. A discount spread is the currency forward points that are subtracted from the spot rate to obtain a forward rate for a currency.

The term basis point has its origins in trading the basis or the spread between two interest rates. Ccs basis spreads were historically close to zero apart from bid ask spreads based on the assumption of banks continuous access to interbank market financing at ibor rates. In foreign exchange fx basis points are commonly referred to as pips price interest points.

The example serves to provide a back of the envelope guide to calculating fx forward points and outright rates. Since the basis is usually small these are quoted multiplied up by 10000 and hence a full point movement in the basis is a basis point.

Traders Are Hedging Risk That Italy Leaves The Euro Again Bloomberg

Traders Are Hedging Risk That Italy Leaves The Euro Again Bloomberg

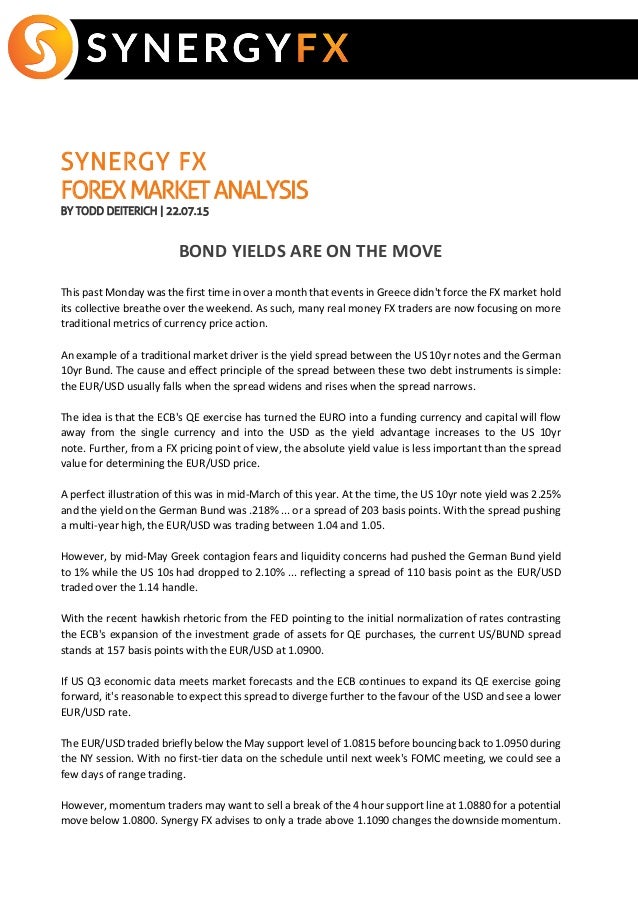

Synergy Fx Forex Market Analysis 22nd July 2015

Synergy Fx Forex Market Analysis 22nd July 2015

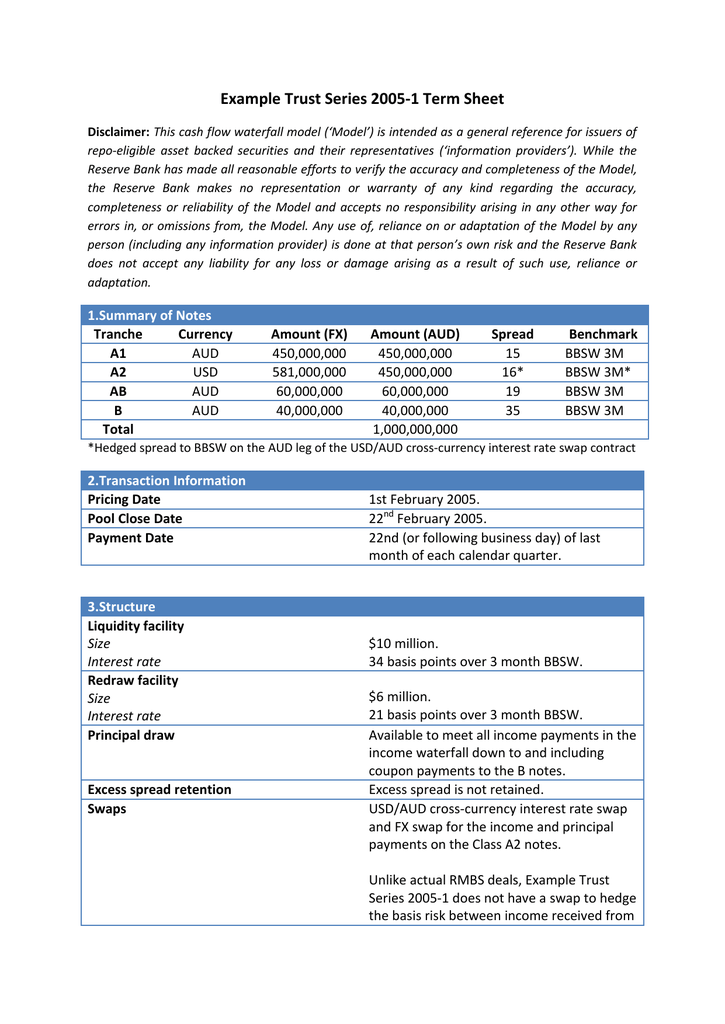

Example Trust Series 2005 1 Term Sheet

Example Trust Series 2005 1 Term Sheet

The Fed S Pivot Is Killing Last Year S Hot Asian Bond Trade Bloomberg

The Fed S Pivot Is Killing Last Year S Hot Asian Bond Trade Bloomberg

/active-trading-lrg-3-5bfc2b25c9e77c00263052a4.jpg) How Is Spread Calculated In The Forex Market

How Is Spread Calculated In The Forex Market

Newbies In Forex Trading Read About Pip And Spread Pipspread

Newbies In Forex Trading Read About Pip And Spread Pipspread

Blowout In Libor Ois Spread Could Give Usd The Boost It Needs

Blowout In Libor Ois Spread Could Give Usd The Boost It Needs

Was Ist Ein Pip

Was Ist Ein Pip

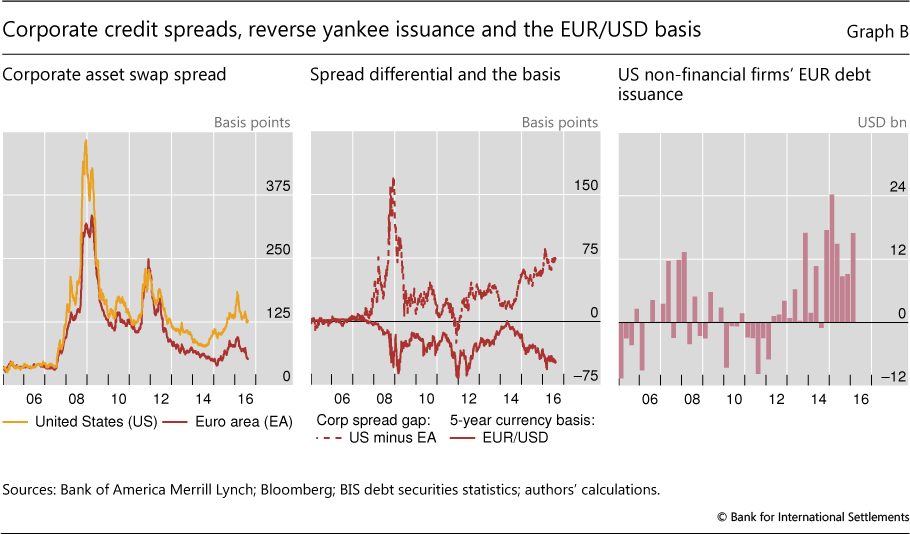

Covered Interest Parity Lost Understanding The Cross Currency Basis

Covered Interest Parity Lost Understanding The Cross Currency Basis

The Financial Crisis Through The Lens Of Foreign Exchange Swap

The Financial Crisis Through The Lens Of Foreign Exchange Swap

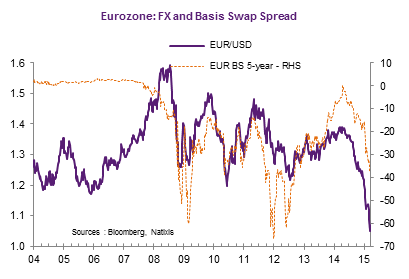

Eur Usd And Cross Currency Basis Swap Seeking Alpha

Eur Usd And Cross Currency Basis Swap Seeking Alpha

Crescat Capital Q1 Why China And The Yuan Are Going To Burst Big Time

Crescat Capital Q1 Why China And The Yuan Are Going To Burst Big Time

Eur Usd Focus On Fed Minutes And Yield Differential

Credit Default Swap Wikipedia